EXPAND/COLLAPSE ALL

Q: What does Cost of Attendance mean?

Cost of Attendance (COA) is the average cost of the program. The Haas Financial Aid Office provides an estimate as the basis for determining financial aid eligibility during the academic program. COA includes both tuition and fees as well as allowances for living expenses, transportation and personal expenses.

Q: What does Cost of Attendance mean?

Cost of Attendance (COA) is the average cost of the program. The Haas Financial Aid Office provides an estimate as the basis for determining financial aid eligibility during the academic program. COA includes both tuition and fees as well as allowances for living expenses, transportation and personal expenses.

Q: Am I required to cover the full COA?

No, the budget items outside of the Program Fees are estimates of additional funds you may need to help cover living expenses and books. Typically, as an Executive MBA student, most opt to only finance the Program Fees. You may accept/apply for loans in an amount less than the Cost of Attendance.

Q: When are the scholarship decisions released?

Review Dates and Decision Dates are noted on our Haas Scholarship page. Please note that you will only be able to apply for Haas Scholarships once admitted into the program. Decision dates are scheduled so that you will know the results of most scholarships prior to the program deposit deadline.

Q: I am an international student. Are there any scholarships offered by Berkeley Haas that are provided to admitted international students?

Yes, most of our scholarships for entering students are open to both international and domestic students.

Q: What is the likelihood of receiving a scholarship? What are the criteria that the school considers while evaluating candidates for scholarships?

Berkeley Haas scholarships are limited and very competitive. The criteria for each award varies.

Q: How is it determined if a candidate will be given more or less scholarship than another? Further, are there ways Haas assists incoming students seeking outside scholarships?

The Executive MBA uses a separate online scholarship application which students complete once they are admitted into the program. Upon submission, your application will be reviewed by the various scholarship committees. Awards are given to students who best meet a scholarship’s criteria, many of which include a short essay. We provide a list of Outside Scholarships for opportunities outside of Haas.

Q: How will my scholarship be disbursed?

If awarded a scholarship, your award will be disbursed in 5 equal payments at the beginning of each term and will be applied to your billable costs..

Q: When should I complete the FAFSA?

Students should complete the FAFSA for the current AND upcoming academic years by the end of April. Doing so will ensure that funds are received by the University and applied towards fees by the course start dates.

Q: What is the main difference between a Private and a Federal Loan?

- Interest Rates – The interest rates for private loans are determined by the borrower’s credit score, where the federal loan interest rates are set by Congress.

- Fees – Private loans tend to have zero fees, while the federal loans have origination fees of approximately 1 and 4%.

- Repayment Plans – The federal loans offer a variety of repayment plans, where private loans offer only a standard repayment plan.

Q: Does Haas have financing options for international students?

Yes, Haas has secured a loan option for international students that do not require a co-signer. These loan is referred to as “risk-share” loans. The current borrowing capacity for the risk-share loan options is $100,000 for the academic program. The lending market has other non-Haas affiliated options that may have better rates and terms. Students are encouraged to shop for lenders that best suit their needs before making a decision.

Q: What does it mean that “students may not combine risk-share lending with other lending?

In addition to our risk-share loans, other lenders, such as Prodigy, offer loans to international students without the need for a co-signer. These lenders will have varying qualifications (e.g., credit check), loan terms and loan maximums. If you are approved for a loan with one of these lenders you may not borrow a risk-share loan as the risk-share loans are intended for those unable to secure a financing option.

Q: When are funds disbursed?

Both federal and private loan funds will disburse directly to the University approximately 10 days prior to the start of the term.

Q: How are federal funds disbursed?

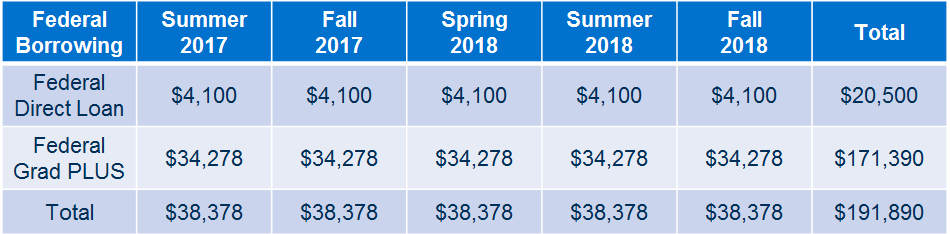

Federal Loan offers are split between the 5 terms of your program:

Q: How are private funds disbursed?

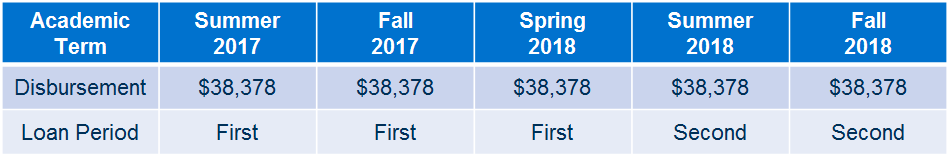

Private loans are certified for loan periods that cannot exceed 365 days. Consequently, you will need to submit a second loan application for the second loan period. If you are approved and certified for the maximum amount (including living expenses), the amount will be disbursed equally among the terms of the loan period.

Q: What percentage of fees will the Post 9/11 GI Bill cover and the Yellow Ribbon?

The Haas School of Business, as part of the public University of California system, is one of the few top ranked MBA programs in the country that is able to benefit from the expanded Post 9/11 Benefits signed into law in January 2011. Depending on the length of the qualifying service, veterans can obtain:

- Funding for up to 100% fees (everything except the Nonresident Tuition)

- A monthly housing allowance (determined by the VA office)

- An annual book stipend up to $1,000

Q: Who do I contact for VA benefits processing?

You must first contact your local VA Office to obtain a copy of your Certificate of Eligibility (COA). We recommend students contact our office once they have accepted admission to begin the process.

Q: How do I obtain documentation for reimbursement through my employer?

Once you have completed your the term and have paid your tuition you will be able to print your account activity from Cal Central. You can also reach out to your program office and request a Grade Letter which would itemize your class with the individual unit load, cost of the course, and the completed grade. Those 2 documents have successfully gotten students reimbursements through their employer.

Q: Does the Graduate Student Instructorship (GSI) Fee Remission get refunded to me?

If you have paid these fees in full using your own resources or loans, the Graduate Student Instructorships (GSI’s) fee remission will be refunded to you. However, fee remissions will not be paid to students as a refund if fees are being covered by outside sources.

Q: Who completes my employer sponsorship?

If your fees are paid by a government agency, foundation, employer, or other outside organization, it is your responsibility to ensure that payment of fees is properly credited. Please have the third party email the Billing Office at [email protected] with an authorization letter on company letterhead.