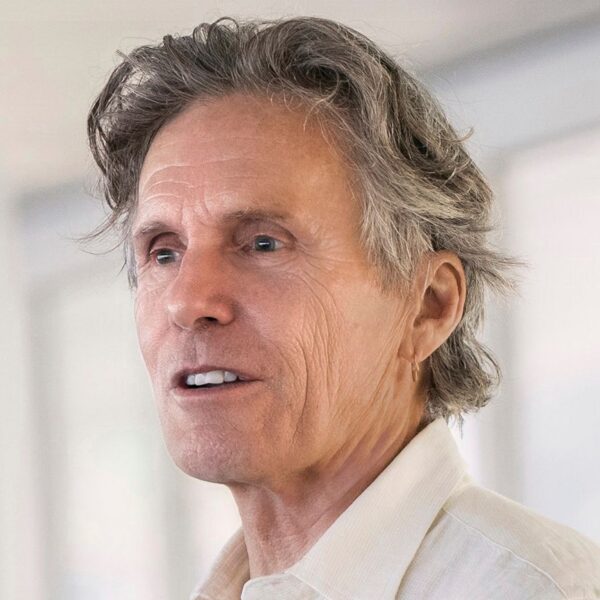

Professor | The Rudd Family Foundation Chair

Finance | Center for Equity, Gender, and Leadership

About

Terrance Odean is the Rudd Family Foundation Professor of Finance at the Haas School of Business at the University of California, Berkeley. He is an advisory editor of the Financial Planning Review, a member of the Journal of Investment Consulting editorial advisory board and of the Russell Sage Behavioral Economics Roundtable, and is a Wall Street Journal Expert Panelist. In 2016, he received the James R. Vertin Award from the CFA Institute for research notable for its relevance and enduring value to investment professionals. He has been an editor and an associate editor of the Review of Financial Studies, an associate editor of the Journal of Finance, a co-editor of a special issue of Management Science, an associate editor at the Journal of Behavioral Finance, a director of UC Berkeley’s Experimental Social Science Laboratory, a member of the Russell Investments Academic Advisory Board, a member of the WU Gutmann Center Academic Advisory Board at the Vienna University of Economics and Business, a visiting professor at the University of Stavanger, Norway, chair of the Haas Finance Group, and the Willis H. Booth Professor of Finance and Banking. As an undergraduate at UC Berkeley, Odean studied judgment and decision making with the 2002 Nobel Laureate in Economics, Daniel Kahneman.

Expertise and Research Interests

- Influence of Individual Investors on Asset Prices

- Investor Behavior

- Behavioral Finance

- Investor Welfare

- Terrance Odean, Brad Barber, Xing Huang, Phillip Jorian, and Christopher Schwarz. The ‘Actual Retail Price’ of Equity Trades. Journal of Finance (forthcoming).

2023 - Terrance Odean, Brad Barber, Xing Huang, Phillip Jorian, and Christopher Schwarz. A (Sub)penny For Your Thoughts: Tracking Retail Investor Activity in TAQ. Journal of Finance (forthcoming).

2023 - Terrance Odean, Mengqiao Du and Alexandra Niessen-Ruenzi. Stock Repurchasing Bias of Mutual Funds. Review of Finance (forthcoming).

2023 - Terrance Odean, Brad Barber, and Shengle Lin. Resolving a Paradox: Retail Trades Positively Predict Returns but are Not Profitable. Journal of Financial and Quantitative Analysis (forthcoming).

2023 - Terrance Odean, Renee Adams, and Brad Barber. The Math Gender Gap and Women’s Career Outcomes. Journal of Investment Management 2023 21, 2, 1-29.

- Terrance Odean, Brad Barber, Xing Huang, and Christopher Schwarz. Attention Induced Trading and Returns: Evidence from Robinhood Users. Journal of Finance, 2022, 77, 6, 3141-3190.

- Disposed to be Overconfident

Katrin Gödker and Paul Smeets. - Leveraging Overconfidence

with Brad M. Barber, Xing Huan, and Jeremy Ko

At Haas since 2001

2008 – present, The Rudd Family Foundation Chair

2006 – 2008, Willis H. Booth Chair in Banking and Finance I

2005 – 2006, Professor, Haas School of Business

2003 – 2005, Associate Professor, Haas School of Business

2001 – 2003, Assistant Professor, Haas School of Business

1997 – 2001, Assistant Professor, Graduate School of Management, UC Davis

- Past Executive Director, Experimental Social Science Laboratory, UC Berkeley

- Past Editor, Review of Financial Studies

- Ad Hoc Referee for: The American Economic Review, The Quarterly Journal of Economics, The Journal of Finance, The Review of Financial Studies, The Journal of Financial Economics, The Journal of Financial and Quantitative Analysis, Journal of Financial Markets, The Financial Analyst’s Journal, The Journal of Business, The Accounting Review, Scandinavian Journal of Economics, The Journal of Psychology and Financial Markets, Journal of Economics and Business, Financial Services Review, Economic Letters, Naitonal Science Review, European Finance Review, Economica, North American Journal of Economics and Finance, Journal of Banking and Finance

James R. Vertin Award

CFA Institute

Carleton College Alumni Distinguished Achievement Award

2012

Barclays Global Investors Award for Best Conference Paper at European Finance Association Meetings

Moscow 2005

Barclays Global Investment / Michael Brennan Prize for the Best Paper of the year (2001) in the Review of Financial Studies Graham and Dodd Award of Excellence

2000

National Science Foundation Career Grant National Science Foundation Research Grant

(SES-0111470)

Roger F. Murray Prize

From the Institute for Quantitative Research in Page 2 9/16/16 Finance

American Association of Individual Investors

2007

Completed Dissertation Award

Award

Nasdaq Foundation Dissertation Fellowship

Fellowship

University of California Regents Fellowship

Fellowship

Departmental Citation

Awarded for outstanding undergraduate accomplishment in statistics

Phi Beta Kappa

Honor Society

- Build Your Own Target-Date Fund, The Street, 05/25/2021

- You Are Not Ready to Start Investing Yet, Medium – Personal Finance Analytics, 05/21/2021

- Long-term vs short-term: Investor mindset matters, Investors’ Chronicle, 04/21/2021

- The lockdown is leading to new bad habits, Napi.hu (Hungarian), 02/15/2021

- Disappointed GameStop Traders Should Take These Lessons to the Next Mania, Bloomberg, 02/08/2021

- ‘Overconfidence’: Why it’s mostly men under 30 trading bitcoin, MarketWatch, 02/08/2021

- Bored Lockdown Traders Are a Danger to Themselves, Bloomberg, 02/04/2021

- UC Berkeley professors, community react to Gamestop stock prices, The Daily Californian, 02/02/2021

- How Does the GameStop Squeeze End?, Gizmodo, 01/29/2021

- Democratising finance, World Finance, 01/25/2021

- Trading Stocks Has Never Been Easier. Here’s How Often Experts Say You Should Buy and Sell, Money, 01/12/2021

- Why men are more likely to invest in Tesla, MarketWatch, 01/12/2021

- Herding by ‘Naive’ Robinhood Traders May Be Good Signal to Short, Bloomberg, 11/13/2020

- Rally democratizes ownership of rare collectibles, but investors should solely focused on ROI should avoid, Sportico, 10/16/2020

- Winning or losing, staying in the game is the thing for some investors, Business Day, 08/24/2020